Dump the excel sheets and get an overview of all your finances. Use the balance sheet tool to gain key insights into your finances and optimize for the life you want.

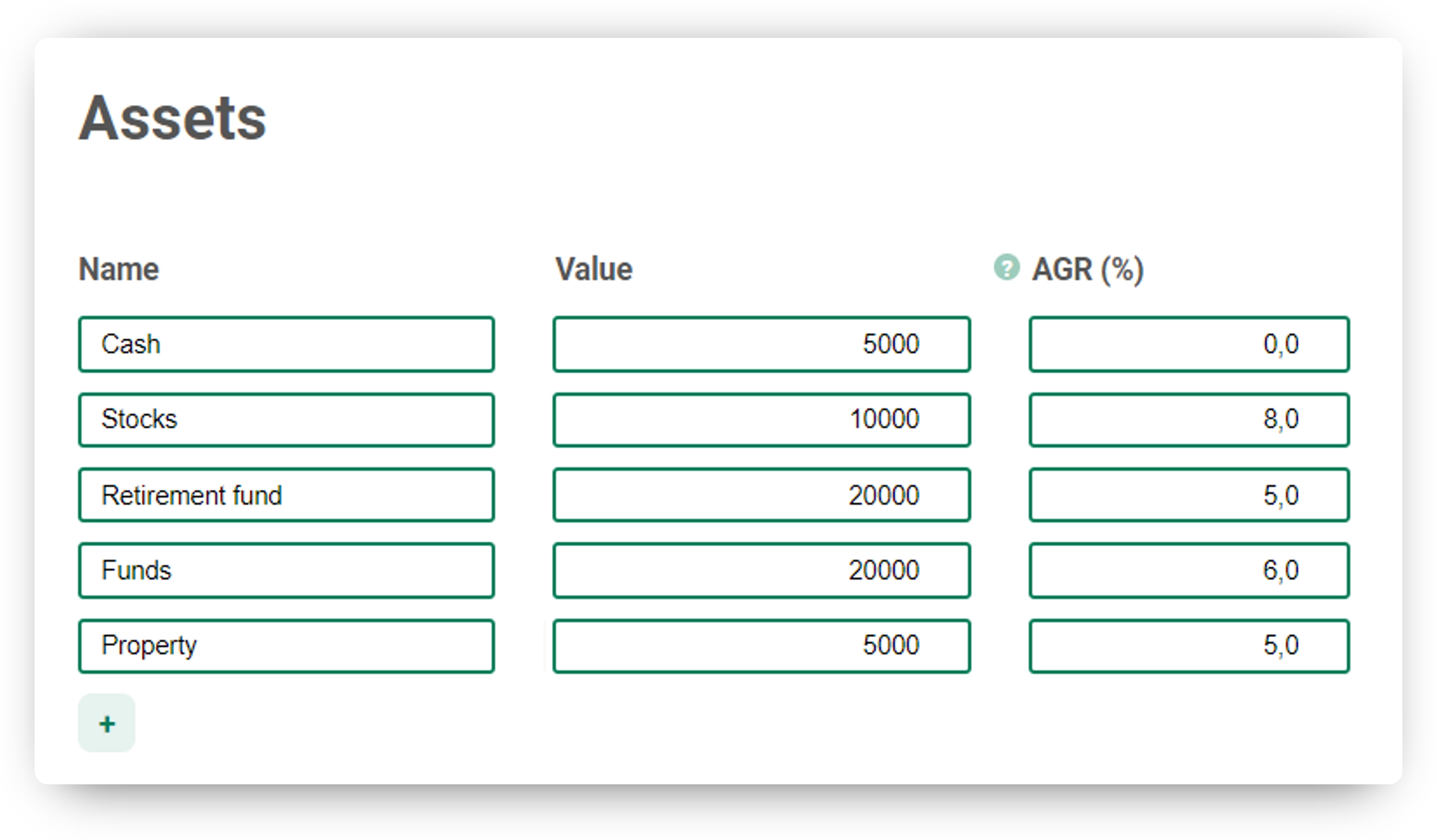

Start by filling out your assets, liabilities, income and expenses with our easy-to-use templates.

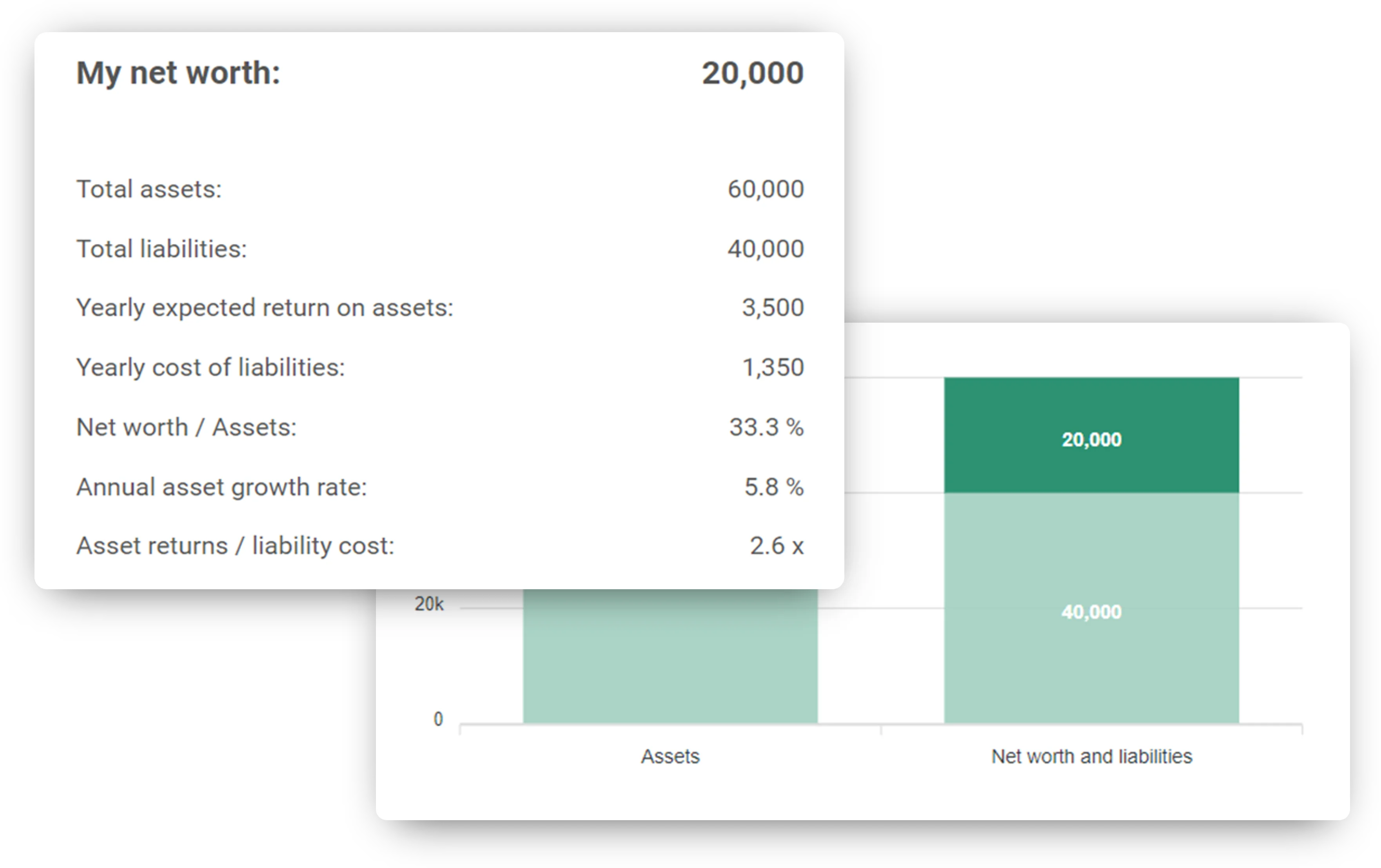

Based on the financial information you filled out, the tool creates an overview of your finances, calculates your net worth and savings potential, and provides a baseline for future projections.

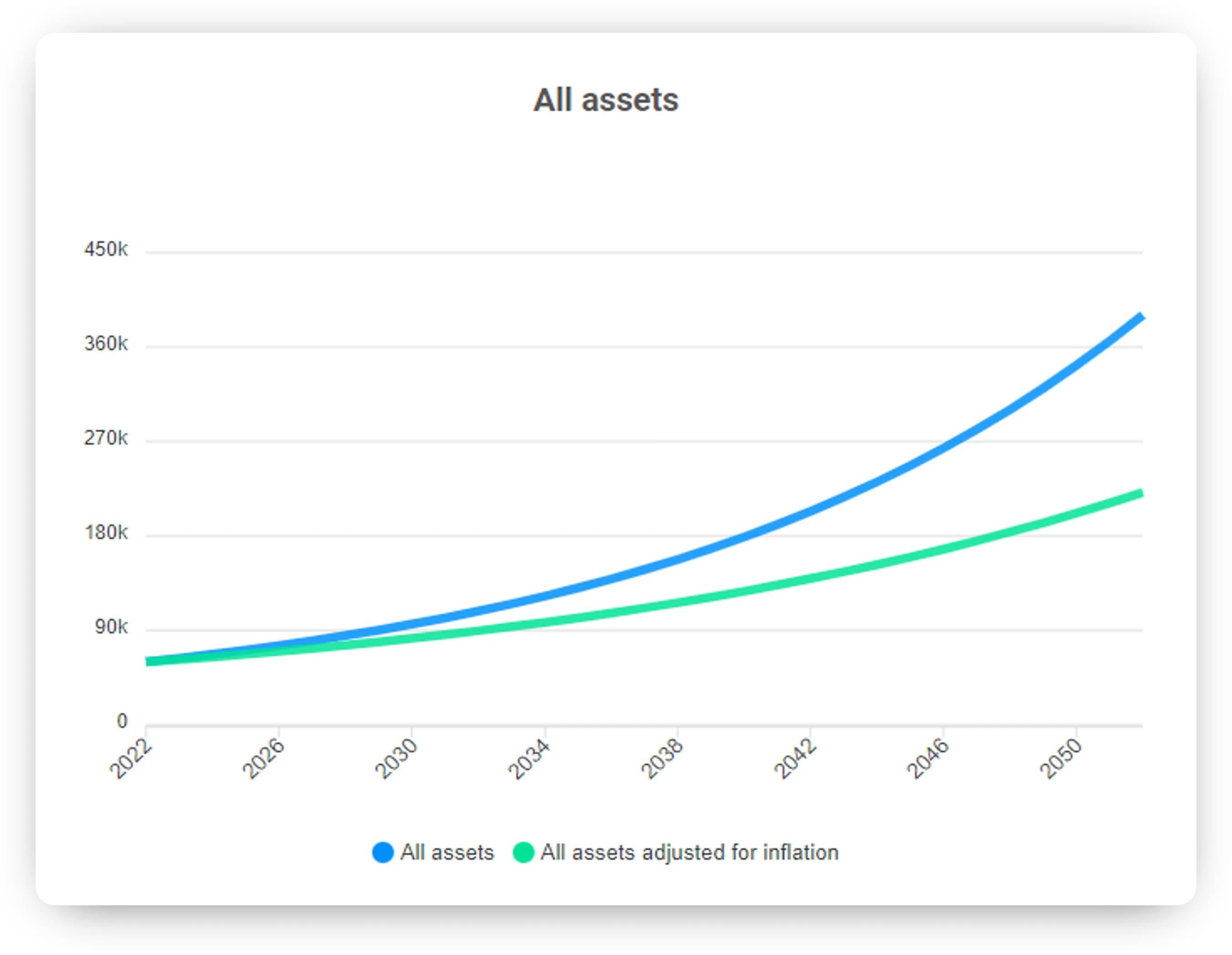

Planning for the future is hard — let the tool make projections for how your assets are expected to develop based on your current asset types and annual growth rates. The projections also include a visualisation of how inflation affects your asset growth.

Balance sheets are used by companies to understand how financially robust the company is. The balance sheet concept can be applied to your personal finances to evaluate your financial strength and status.

The BS tool gives an overview of your assets, liabilities, and net worth. Knowing your net worth is your first step to financial freedom and the life you want.

Everything you own that has value or can create value and be converted into money, such as property, stock investments, cash, pension funds, savings accounts, collectibles and cars.

Your assets are all items of value that you control, including assets purchased with liabilities. Assets that steadily increase over time can give exponential growth to your net worth.

How much of your assets are actually yours? Your net worth is the difference between your assets and your liabilities.

Assets — Liabilities = Net worth.

All that you owe someone else such as mortgages, student loans, credit card debt, and car loans.

Calculate your net worth

List the things you own that have value or can create value and be converted into money, such as property, stock investments, pension funds, savings accounts, collectibles, and cars.

List everything that you owe someone else such as mortgages, student loans, credit card debt, and car loans.

€4.99

per month

Personal finance overview

Net worth overview

Future asset value prediction tool

Inflation & savings effects calculator

14 days free trial

We act independently of sponsoring third parties, ads and financial institutions and believe in taking a fair price for a well-made product. That way we can continue doing what we love, which is building a great product for you, and you can feel safe that we'll never sell your data or promote third party products.